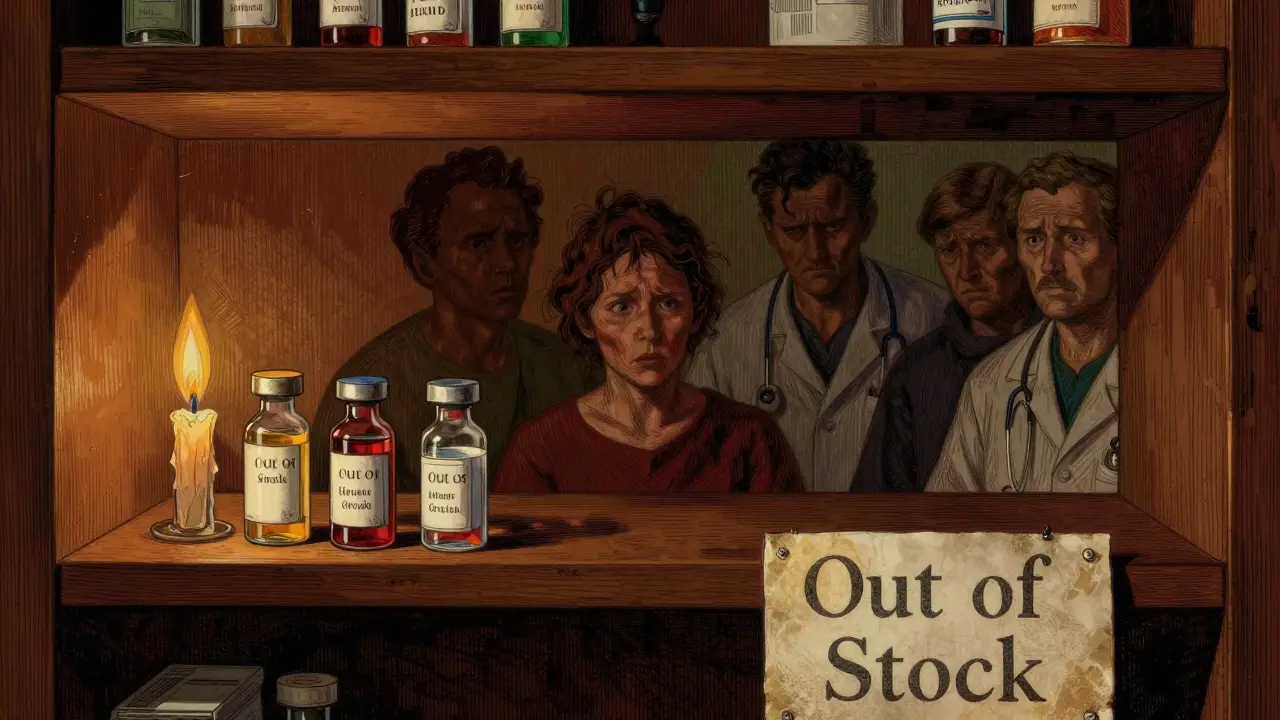

By 2025, nearly one in five prescription drugs in the U.S. and Europe are at risk of running out for weeks or months at a time. This isn’t random. It’s predictable. And it’s getting worse.

Think about the last time you filled a prescription for metformin, levothyroxine, or amoxicillin - and found it unavailable. You weren’t unlucky. You were caught in a system that’s been quietly unraveling for years. Drug shortages aren’t accidents. They’re the result of complex, interconnected pressures: raw material bottlenecks, factory shutdowns, regulatory delays, and global supply chain fragility. And now, with forecasting tools getting smarter, we can see what’s coming - and who will be hit hardest.

Why Drug Shortages Are Getting Harder to Ignore

In 2024, the FDA recorded over 300 active drug shortages in the U.S. alone. By mid-2025, that number had climbed to 387. The most common culprits? Generic injectables - drugs like doxorubicin, insulin, and phenylephrine. These aren’t luxury medications. They’re lifelines for cancer patients, diabetics, and people in emergency rooms.

What’s changed? It’s not just one problem. It’s a chain reaction. Most generic drugs are made in just a handful of factories - mostly in India and China. If one plant shuts down for a regulatory inspection, or if a key chemical ingredient gets delayed at customs, the entire supply chain freezes. There’s no backup. No buffer. And no one’s building more factories.

Take the case of sodium bicarbonate, used in kidney dialysis. In 2023, a single facility in India halted production for six months. The U.S. had zero domestic manufacturing capacity. The result? Hospitals rationed doses. Patients got delayed treatments. This wasn’t an outlier. It’s becoming the norm.

How Forecasting Works - And Why It’s Finally Accurate

For years, drug shortage predictions were guesswork. Now, agencies like the FDA, WHO, and private analytics firms use real-time data feeds to spot trouble before it hits shelves.

Here’s how it works:

- They track raw material shipments - especially active pharmaceutical ingredients (APIs) - from source countries.

- They monitor factory compliance reports. A single FDA warning letter can trigger a shortage six months later.

- They analyze global trade patterns. If China restricts exports of a certain chemical, shortages follow within 8-12 weeks.

- They track inventory levels at wholesalers and hospitals. When stock drops below 30 days’ supply, alarms go off.

By combining these data streams, forecasters can now predict shortages with 80% accuracy up to nine months ahead. That’s not perfect - but it’s enough to act.

For example, in early 2025, a forecasting model flagged a 40% drop in API shipments from India for the antibiotic ciprofloxacin. By May, the FDA issued a public alert. Pharmacies started rationing. Hospitals switched to alternatives. Without that warning, thousands of patients would’ve been left without treatment.

The Big Five Drivers of Future Shortages

Five forces are pushing drug scarcity into a new era. None of them are going away.

1. Geopolitical Fragmentation

Trade wars, export bans, and sanctions are breaking global supply chains. In 2024, India banned exports of 18 APIs to protect its domestic market. China restricted rare earth metals used in drug packaging. The U.S. and EU are now pushing for “friend-shoring” - moving production to allied countries. But building new facilities takes 3-5 years. In the meantime, gaps widen.

2. Climate Disruption

Extreme weather is hitting raw material sources. In 2023, floods in Gujarat, India, shut down 12 API plants for months. Droughts in Brazil cut coffee bean supplies - which also affects the production of caffeine-based stimulants used in hospitals. Climate models now show that by 2027, 30% of global API production sites will be in regions with high climate risk.

3. Aging Workforce and Skills Gap

Pharmaceutical manufacturing requires highly trained technicians. But in the U.S., the average age of a production worker is 52. Fewer young people are entering the field. The WHO estimates a global shortfall of 200,000 qualified pharmaceutical technicians by 2030. Without them, factories can’t run at full capacity - even if they have the materials.

4. Regulatory Delays

The FDA and EMA are overwhelmed. In 2024, the average approval time for a generic drug application was 22 months - up from 14 months in 2020. Many applications are incomplete or flagged for minor paperwork errors. One delay can mean a drug vanishes from shelves for over a year.

5. Economic Pressure on Manufacturers

Generic drug makers operate on razor-thin margins. When a drug sells for $0.10 per pill, there’s no room for error. If a factory has a minor quality issue, it’s cheaper to shut down than fix it. And with no profit incentive to build redundancy, companies don’t invest in backup lines. Why make extra when you barely make enough to survive?

Who’s Most at Risk?

Not everyone feels drug shortages the same way.

Low-income patients? They’re hit hardest. When metformin disappears, they can’t afford the brand-name version. When insulin runs out, they ration doses - and risk diabetic ketoacidosis.

Chronic disease patients? Their conditions require consistent medication. Missing a week of levothyroxine can send thyroid levels spiraling. Missing a month of warfarin can cause a stroke.

Hospitals? They’re forced to use more expensive alternatives, which strains budgets. A single switch from generic to branded antibiotics can cost a hospital $50,000 extra per month.

And rural clinics? Many don’t have the inventory buffers or purchasing power to find alternatives. They’re often the last to know a drug is gone - and the first to run out.

What’s Being Done - And What’s Not

Some progress is happening. The U.S. passed the Drug Supply Chain Security Act in 2013. It’s slowly improving traceability. The FDA now maintains a public shortage list. Some states are creating emergency stockpiles of critical drugs.

But these are bandaids. Here’s what’s missing:

- No federal funding to build domestic API manufacturing capacity.

- No incentives for companies to maintain backup production lines.

- No global coordination on raw material access.

- No requirement for hospitals to report real-time inventory levels.

The World Health Organization has called for a global drug shortage early-warning system. So far, it’s just a proposal.

What You Can Do - Even If You’re Not a Pharmacist

You don’t need to be in the industry to prepare.

- Ask your pharmacist: “Is this drug on the shortage list?” They have access to the FDA’s database.

- Keep a 30-day supply of essential medications on hand - if your insurance allows it.

- Know your alternatives. If your thyroid med is out, ask if levothyroxine sodium is available. It’s the same thing.

- Join patient advocacy groups. Pressure on lawmakers works. In 2024, public outcry led to the emergency import of 500,000 doses of insulin from Canada.

And if you’re a caregiver, keep a written list of all medications - including dosages and reasons for use. When a drug disappears, that list becomes your lifeline.

What’s Coming Next - 2026 to 2030

Forecasters predict the worst is yet to come.

By 2027, 15% of all injectable drugs will be in short supply. By 2029, cancer treatments like vincristine and doxorubicin may be rationed by age or stage of disease. Insulin shortages could become seasonal - worsening in winter when demand spikes.

And the biggest threat? A single global event - a major earthquake in India, a cyberattack on a Chinese API plant, or a trade embargo - could trigger a cascade of shortages across dozens of drugs at once. We’ve seen this happen with PPE during COVID. Now it’s happening with medicine.

The good news? We can see it coming. The bad news? We’re not acting fast enough.

Drug shortages aren’t just a healthcare issue. They’re a national security issue. A moral issue. A failure of planning.

If we wait until the shelves are empty to fix this, it’ll be too late. Forecasting isn’t about predicting doom. It’s about giving us time to prepare - before someone dies because a pill wasn’t there when they needed it most.

Write a comment