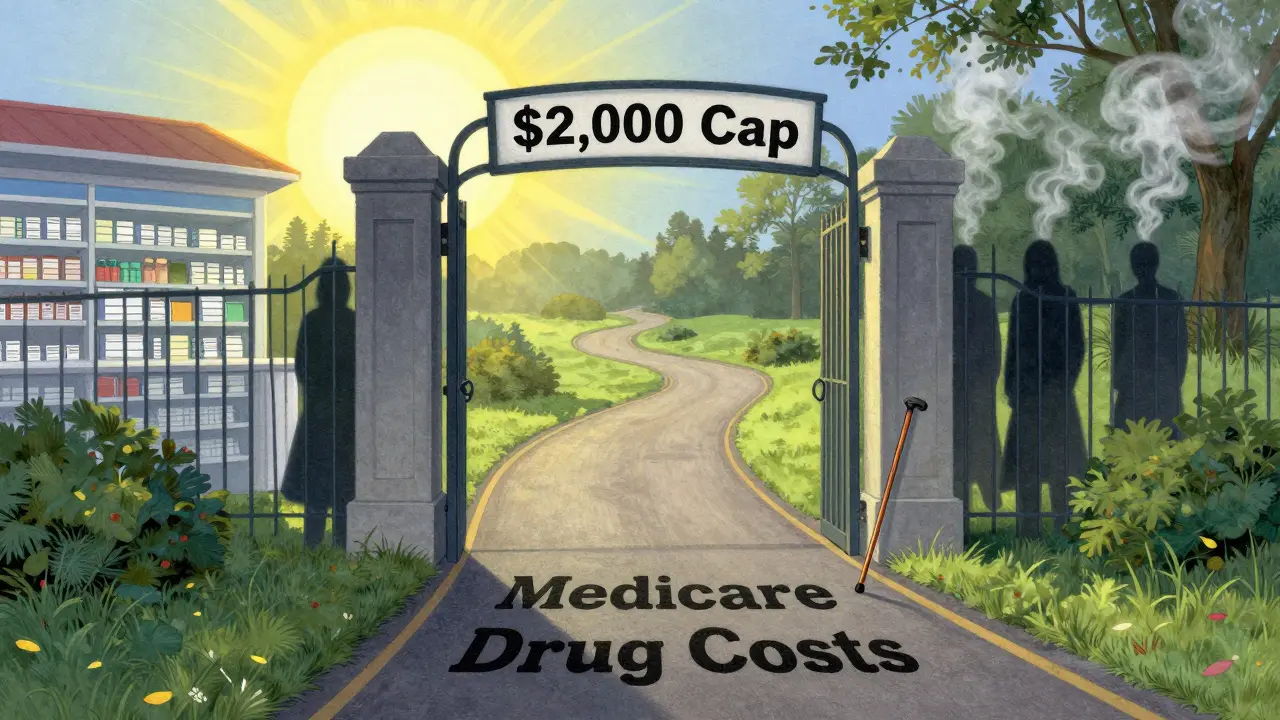

Starting in 2025, Medicare drug coverage changed in ways that could save you thousands. If you’re on Medicare and take regular prescriptions, you need to know about the new $2,000 annual cap on out-of-pocket drug costs. This isn’t a small tweak-it’s the biggest shift in Medicare Part D since it began in 2006. No more falling into the "donut hole" where your meds suddenly became unaffordable. Now, once you hit $2,000 in spending on covered drugs in a year, you pay nothing for the rest of the year. That’s it. No more surprises. No more guessing how much your next refill will cost.

How Medicare Part D Works Now (2025-2026)

Medicare Part D is your prescription drug coverage. It’s not automatic-you have to sign up for it through a private insurance company that works with Medicare. There are two main ways to get it: as a standalone plan (called a PDP), or bundled into a Medicare Advantage plan (MA-PD). In 2025, you’ll have about 48 plan options on average, but that number is shrinking. Stand-alone drug plans dropped from 21 to 14 in just one year. Most people are now choosing Medicare Advantage plans that include drug coverage, because they bundle doctor visits, hospital care, and prescriptions into one plan.

Here’s how your costs break down now:

- Deductible: Up to $590 per year. Some plans have no deductible at all.

- Initial Coverage: After you meet your deductible, you pay 25% of the drug cost. The plan pays 65%, and drug makers chip in 10%.

- Out-of-Pocket Cap: Once you’ve spent $2,000 on covered drugs (including deductible, copays, and coinsurance), you’re done paying for the rest of the year.

- Catastrophic Coverage: After hitting the $2,000 cap, you pay $0 for covered drugs. The plan pays 60%, the drug maker pays 20%, and Medicare pays 20%.

Important: Only what you pay out of pocket counts toward the $2,000 cap. Your monthly premium doesn’t count. If you take a drug that’s not on your plan’s list (formulary), that cost doesn’t count either.

The $2,000 Cap: Who Benefits the Most?

This cap isn’t just a nice perk-it’s life-changing for people taking expensive medications. If you’re on insulin, cancer drugs, or multiple chronic condition meds, you’ve likely spent thousands out of pocket in past years. One beneficiary in Florida said she paid $6,800 for cancer drugs in 2024. In 2025, she’ll pay no more than $2,000. That’s a $4,800 savings in one year.

But it’s not just for people with rare or expensive drugs. Even if you take three or four maintenance medications-like blood pressure pills, statins, or diabetes meds-you could hit the cap. For example, if your monthly drug costs add up to $200, you’ll hit the $2,000 limit by October. After that, your meds are free for the rest of the year.

Insulin is another big win. Thanks to the Inflation Reduction Act, insulin costs are capped at $35 per 30-day supply for both Part B and Part D. If you use insulin, you’re saving an average of $1,150 a year. That’s more than $95 a month in your pocket.

Extra Help: Low-Income Cost Assistance

If your income is low, you might qualify for Extra Help-a federal program that pays for your Part D premiums, deductibles, and copays. About 14.5 million people get this benefit. In 2025, if you’re single and make less than $22,590 a year (or $30,660 for a couple), you’re likely eligible. Even if you’re just slightly above that, you might still qualify for partial help.

Extra Help isn’t just about lowering your monthly bill. It also means you won’t pay a late enrollment penalty if you didn’t sign up for Part D when you first became eligible. And if you get Extra Help, you automatically get the $2,000 cap without having to do anything extra.

To apply, go to SSA.gov/extrahelp or call Social Security at 1-800-772-1213. You can also ask your local State Health Insurance Assistance Program (SHIP) counselor. They help for free.

What You Need to Do Before December 7

You have until December 7, 2025, to change your Part D plan for 2026. This is called the Annual Enrollment Period. Most people just let their plan renew automatically. That’s a mistake. Plans change every year-what was cheap last year might be expensive now. Your favorite pharmacy might drop out of the network. Your drug might get moved to a higher cost tier.

Here’s how to check your plan:

- Go to Medicare.gov/plan-compare and enter your zip code.

- Input your exact medications, dosages, and how often you take them.

- Enter your preferred pharmacy.

- Look at the "Total Drug Cost" estimate-it includes your premium, deductible, and expected copays for the year.

Don’t just pick the cheapest premium. A plan with a $10 monthly premium but a $200 copay for your main drug might cost you $1,000 more a year than a plan with a $40 premium and a $10 copay.

Use the Medicare Plan Finder tool. It’s the most accurate way to compare. In 2024, 92% of users said it helped them make a better choice.

Watch Out for These Traps

Even with the new rules, there are still pitfalls.

- Pharmacy networks change. Your local CVS or Walgreens might not be in-network anymore. Check your plan’s pharmacy list before you enroll.

- Formularies change. Your drug might still be covered, but now it’s in a higher tier with a bigger copay. Or it might be removed entirely.

- Not all costs count toward the cap. Premiums, non-covered drugs, and drugs bought outside your plan’s network don’t count. You might think you’re close to the cap, but you’re not.

- Don’t assume your plan is the best. In 2025, 83% of people didn’t review their plan. That means most people are paying more than they need to.

One man in Texas had been on the same plan for eight years. In 2025, his preferred pharmacy was no longer in-network. He had to switch plans-even though his drugs were still covered. He ended up paying $180 more per month because he didn’t check.

Where to Get Free Help

You don’t have to figure this out alone. Every state has free counselors through the State Health Insurance Assistance Program (SHIP). They’re trained Medicare experts who don’t sell plans. They help you compare options, understand your drugs, and fill out forms.

Find your local SHIP at shiptacenter.org or call 1-877-839-2675. They helped over 4 million people in 2024.

Also, Medicare Rights Center offers free webinars and guides. They found that 78% of beneficiaries didn’t know about the $2,000 cap before they got help. You don’t have to be one of them.

What’s Coming in 2026

The $2,000 cap will rise slightly to $2,100 in 2026 to adjust for inflation. That’s still a massive improvement from the $7,400 cap just two years ago. CMS is also upgrading the Medicare Plan Finder tool to show you exactly how much you’ll spend on each drug across plans. By October 2025, you’ll be able to see a breakdown of your total annual cost for each medication.

Expect fewer stand-alone drug plans. Analysts predict the average number of PDPs will drop to just 10 per person by 2027. That means your choices will keep shrinking. The best move? Lock in a plan now that covers your drugs, has your pharmacy, and fits your budget. Don’t wait for a better deal that might not come.

Final Thought: Don’t Guess-Check

Medicare Part D used to be a minefield. Now, it’s simpler, but only if you pay attention. The $2,000 cap, the $35 insulin limit, and Extra Help are real savings. But they won’t help you if you don’t know they exist-or if you stick with a plan that doesn’t cover your meds.

Take 90 minutes before December 7. Use Medicare.gov. Talk to a SHIP counselor. Compare your drugs. You might save hundreds-or thousands. That’s not just money. That’s peace of mind.

Does the $2,000 out-of-pocket cap include my monthly Part D premium?

No, your monthly premium does not count toward the $2,000 out-of-pocket cap. Only what you pay directly for your prescriptions-like deductibles, copayments, and coinsurance-counts. Premiums are separate and must be paid regardless of how much you spend on drugs.

Can I switch Part D plans anytime during the year?

You can only change plans during the Annual Enrollment Period, which runs from October 15 to December 7 each year. There are a few exceptions, like if you move out of your plan’s service area, qualify for Extra Help, or enter a nursing home. Otherwise, you must wait until next year’s enrollment period.

What if my drug isn’t covered by my Part D plan?

If your drug isn’t on your plan’s formulary, you’ll pay full price out of pocket, and that cost won’t count toward your $2,000 cap. You can ask your plan for a formulary exception, or switch to a different plan during open enrollment that covers your medication. Always check your plan’s drug list before enrolling.

Do I need to reapply for Extra Help every year?

No, once you qualify for Extra Help, your eligibility is automatically renewed each year unless your income or resources change significantly. You’ll get a notice from Social Security if your benefits are about to end. If you’re unsure, call Social Security at 1-800-772-1213 to confirm your status.

Are all insulin brands covered under the $35 cap?

Yes, all FDA-approved insulin products are covered under the $35 monthly cap under Medicare Part D and Part B, regardless of brand or type. This includes both brand-name and generic insulins. The cap applies to each 30-day supply, so if you use multiple types of insulin, each one is capped at $35.

Write a comment